- Investing for Income

- Posts

- End of 2022 Portfolio Review

End of 2022 Portfolio Review

My Top 10 Holdings of 2022 Portfolio Review

What a year 2022 has been in the stock market. The whole market was down this year due to uncertainties with interest rates, the war in Ukraine, Covid, unemployment and more. In times like this, the best thing to do is to continue investing. In the above image, you can see my top 10 holdings. My top holding is FZROX (Fidelity Zero Total Market Index Fund). By using this fund, I am able to invest in the entire market at once. This is one of my most important investments and the only one I hold in my Roth IRA. The power of the Roth IRA is that your investments will grow tax-free. The rest of my investments are in taxable accounts and I like to own a mix of growth and income-producing assets. Here's a breakdown of my current top 10 holdings:

My Top 10 holdings-

1) FZROX (Fidelity Zero Total Market Index Fund)- this index fund invests in the total stock market and has zero fees. I have a monthly automatic investment set up to go into this fund in my Roth IRA for tax free growth. The market was down approximately 20% this year so that’s like investing at a discount. The market constantly goes up and down but over a long period of time, it goes up. Over the long term, the market has profited approximately 8- 10% per year on average. 2) SCHD (Schwab U.S. Dividend Equity ETF)- This fund invests in quality dividend paying stocks across many sectors. It offers a dividend yield of 3.38%, pays quarterly, and has grown the dividend consistently for the past 10 years. It offers a great combination of dividends and growth as it has returned roughly 46% over the past 5 years and roughly 159% over the past 10 years. 3) JEPI (JPMorgan Equity Premium Income ETF) -

JEPI is a fund that uses a complex strategy known as selling options. It sells options on stocks in many sectors that have shown financial and environmental responsibility. It pays a dividend yield of 11.62% and pays monthly.

4) VOO (Vanguard S&P 500 ETF)-

This fund invests in the 500 largest U.S. companies. This is one of my most import investments for the long term. While the performance is down about 20% this year, it has gained ~41% over the past 5 years and ~162% over the last 10 years. This is a great foundation for any portfolio as the market tends to rise over many years.

5) QQQ (Invesco QQQ ETF)-

This fund invests in global growth and value stocks of large cap companies. This fund is also diversified across many sectors. In 2022, this fund has been down ~33% but it has gained ~66% over the past 5 years and ~300% over the past 10 years.

6) PFLT (Pennant Park Floating Rate Capital)-

PFLT is a business development company. It invests in many things including debt, equity, and loan investments. Approximately 80% of its net assets in addition to any borrowed funds is invested in floating rate loans and similar investments. Floating rate loans are held for a period of three to ten years. PFLT pays a monthly dividend of 10.32%. 7) TIP (iShares TIPS Bond ETF)-TIP is a taxable bond etf. The fund invests in fixed-income securities which primarily consist of fixed-rate, investment grade inflation-protected public obligations of the U.S. Treasury that have at least one year until maturity. It pays a monthly dividend yield of 6.94%. 8) ZIM (ZIM Integrated Shipping Services Ltd)-

Probably the riskiest holding on this list, ZIM, has dropped in 2022 by an enormous 70%. ZIM provides container shipping and related services in Israel and internationally. Surprisingly, it pays a quarterly dividend of ~166%! This stock should be watched closely as a dividend this high is usually not normal and may be cut or reduced at any time. 9) SBLK (Star Bulk Carriers)-

Another shipping company, SBLK has been down about 10% in the past year. This company transports a range of goods such as iron ores, coal, grains, bauxite, fertilizers and steel products. It pays a quarterly dividend of ~24%. 10) PSEC (Prospect Capital Corporation)-

PSEC is a business development company. This company has a large list of financial investments some of which include many types of loans, debts, and multi-family real estate investments. It pays a monthly dividend of 10.20%.

Along with buying companies and funds with the potential to provide growth, I also enjoy investments that provide income through the distribution of dividends. Dividends are a distribution of profits from a company to the shareholders. When you buy a stock, you buy a small piece of ownership in a company and this makes you entitled to receive a small part of the company’s profits. Dividends may eventually provide a good source of income. As I go into 2023, my dividend income stands at $193 per year. Disclaimer: none of the stocks or funds mentioned are meant to serve as specific financial advice. I am simply showing what I invest in and sharing my opinions. I am also encouraging further research which can be done at SeekingAlpha.com. All investing involves risk but not investing involves even more risk. If you need any help getting started with investing or have questions you can reach me on Twitter @yaninvests.

If you would like to use the portfolio tracker I use you can find it here:

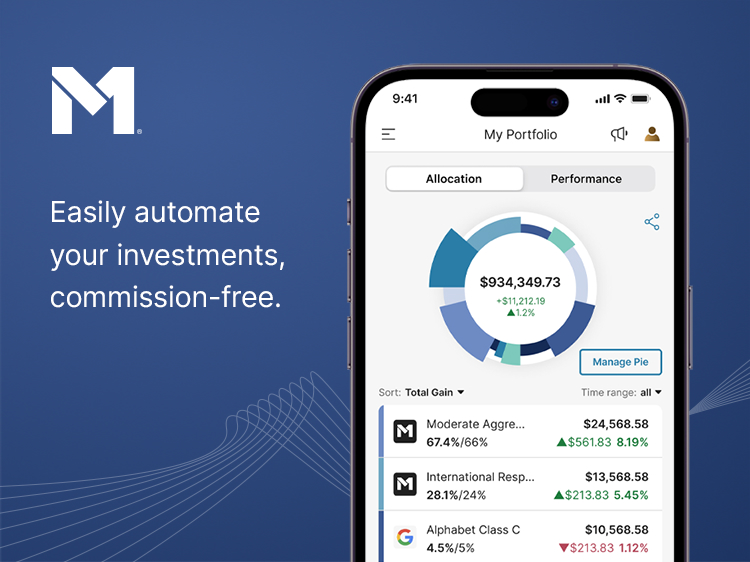

The following links are for services and products I use and recommended. If you sign up using my link, I may receive a small commission at no extra charge to you. You will also receive a sign up bonus if you decide to sign up with M1 Finance, Webull, or E*Trade.

Sign up for M1 Finance:

Sign up for Webull:

Sign up for E*Trade:

Reply